by Krishna Palepu – Director of Applications

Introduction

As part of the Accounts Receivable (AR) period close checklist, it is crucial to complete the scheduled process of preparing the Receivables for the General Ledger (GL) Reconciliation. Additionally, the AR to GL Reconciliation report should be executed to help quickly close the AR period. This report helps to identify any differences, which can then be reviewed with the help of the Differences report to determine potential causes and make appropriate corrections

This process is important for clients across all industries that utilize the Oracle ERP system. In this blog, we will explain why AR to GL Reconciliation is important, provide details on how to prepare the ERP system for Reconciliation and offer suggestions to those who are new to AR Reconciliation.

What is AR to GL Reconciliation, and Why Does it Matter?

Accounts Receivable (AR) involves transactions and receipts that can be categorized as invoices, debit memos, or credit memos. Adjustments may be made to these transactions. The accounting process for these transactions and receipts occurs in the subledger, and they must be reconciled with their account balances in the General Ledger (GL). In large enterprises, there is a high volume of these transactions, and discrepancies can lead to inaccurate GL balances. To address this issue, Oracle provides a feature to perform reconciliation and identify discrepancies. By resolving these discrepancies, the AR and GL balances can be tied, ensuring accurate financial reporting.

How to Reconcile AR to GL

Activities to be performed:

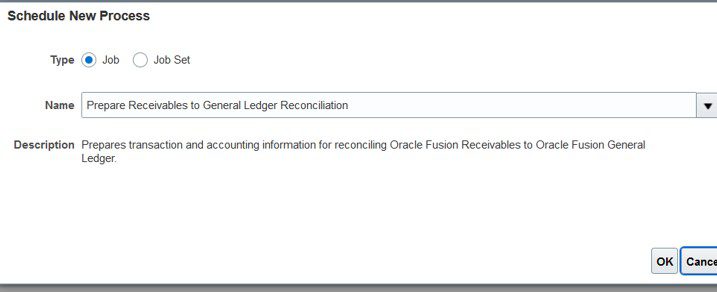

1. Run the Prepare AR to GL Reconciliation scheduled process.

2. Review the Receivables to Ledger Reconciliation Report.

a. If Differences exist, review the associated Differences report for potential causes, and make appropriate corrections.

b. If Variances exist, contact IT or Oracle Support for assistance.

c. If an amount exists for Other Accounting, review the activity. If activities other than intercompany and manual journals sourced from AR exist, this may indicate an incorrect setup.

d. If there are no differences, you may still want to review the detailed reports to verify GL accounts.

3. Once all differences have been resolved, rerun the Prepare Receivables to General Ledger scheduled process and review the Reconciliation Report to confirm differences are cleared.

4. Navigation paths for each action, process, or report:

a. Close Period Navigation: Receivables Balances Work Area > Receivables Periods Task: Manage Accounting Periods

b. Create Accounting Navigation: Tools: Scheduled Processes > Schedule New Process > Create Receivables Accounting or Receivables Balances Work Area > Accounting task: Create Accounting

c. Correct Journal Navigation: Menu > Action > View Accounting> Override Account

Period Close Exceptions Navigation: Tools: Scheduled Processes > Schedule New Process > Subledger Period Close Exceptions Report

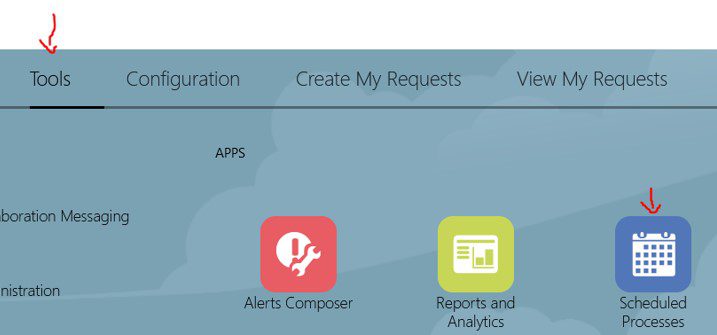

d. Prepare Reconciliation data Navigation: Tools: Scheduled Processes > Schedule New Process > Prepare Receivables to General Ledger Reconciliation

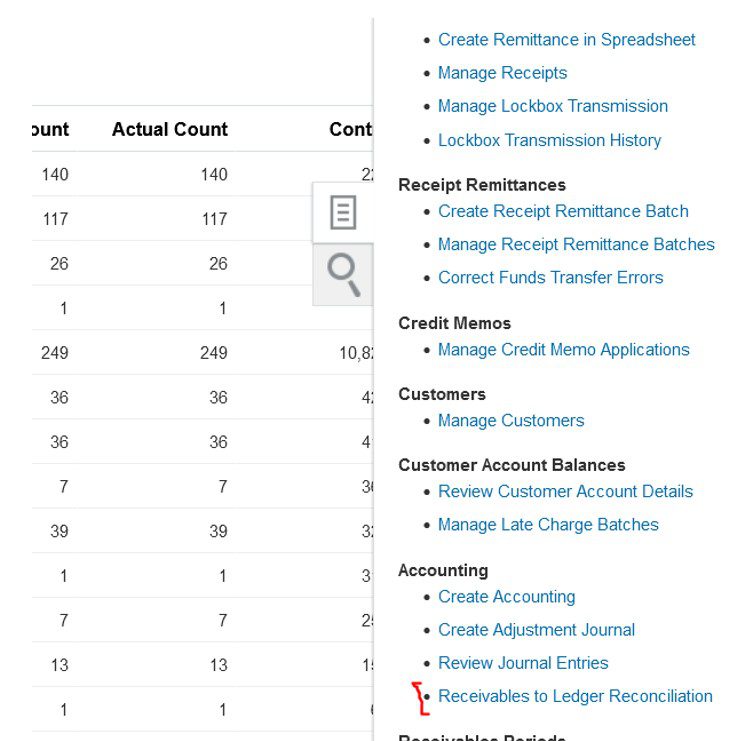

e. Review Reconciliation Report Navigation: Receivables Balances Work Area > Accounting task: Receivables to Ledger Reconciliation

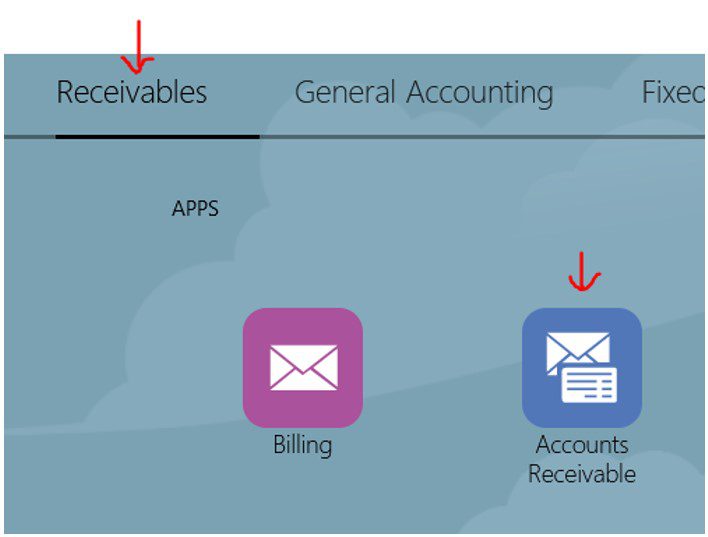

5. Navigation

6. Receivables > Accounts Receivable

7. Click on the Sandwich icon on the right and select Receivables to Ledger Reconciliation

8. Prerequisite

9. Select Tools > Scheduled Processes

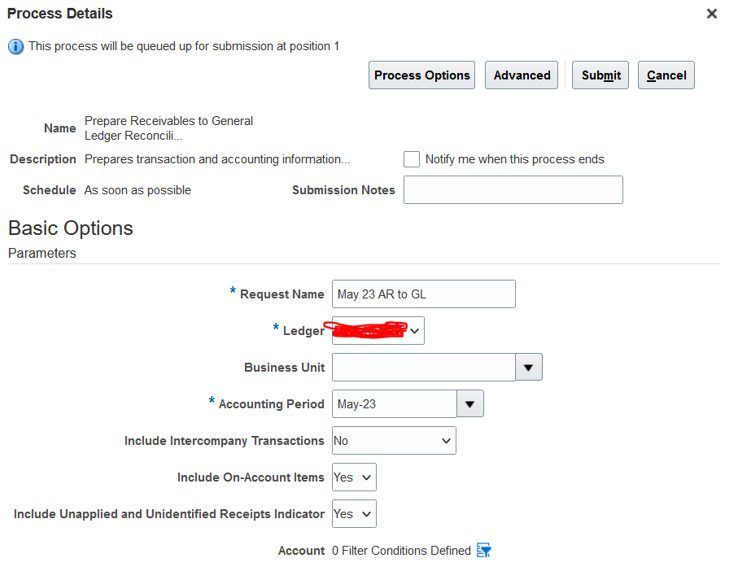

10. Schedule a New Process based on the settings shown below

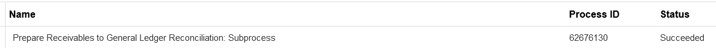

11. Ensure that the process was completed successfully

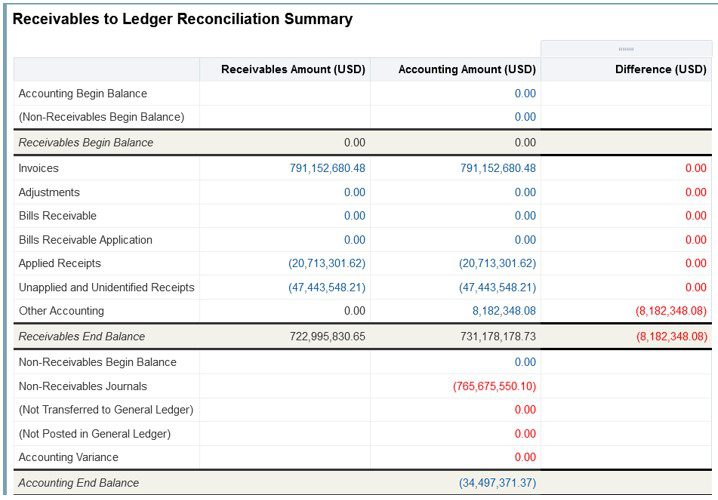

12. Open the Reconciliation report and review for discrepancies to ensure it’s correct

Tips and Reminders for AR to GL Reconciliation

The following observations can be made from the above screenshot. The Other Accounting section has an Accounting Amount, and there is no amount listed under Receivables Amount.

The purpose of this report is to check the value of the financial category for the accounts listed in the drill-down (detailed report)

If you define an account with the Financial category ‘Receivables’ you should use this account as follows:

- For invoices, this account should be used in Receivables lines. If you use the account as a Revenue account, you will get Other Accounting differences.

- For Receipts, this account should be used in Receivables lines. Receivable lines include (‘UNID’, ‘UNAPP’, ‘CLAIM’, ‘ACC’). If you use the account as CONFIRMATION or REFUND you will get Other Accounting differences.

Centroid’s Financial Implementation Expertise

As discussed throughout this blog, the AR to GL Reconciliation offers a comprehensive view of accounting transactions, which is useful in facilitating period close activities. You can find more information on this topic by referring to the Oracle User Guides or reaching out to Oracle Support.

Moreover, Centroid can assist as we have expertise in financial implementations, and can provide you with the best practices for utilizing Oracle Out of the Box reports to achieve faster period-close.

If you have any further questions about AR to GL Reconciliation using Oracle Cloud Fusion, you can contact the author directly or contact our office.

Krishna Palepu – Director of Applications

Email: [email protected]

LinkedIn: www.linkedin.com/in/krishna-p-7229285/